Dividend Tax Rate 2024/25 2024

Dividend Tax Rate 2024/25 2024. Thanks to the 2024 spring budget finding the optimal blend of salary and dividends for company owners is a little more complicated than in previous years. For the 2024/25 tax year this is £758 a month or £9,096 per annum.

You’ll be paying 8.75% on dividends above the. For the 2024/25 tax year, dividend income beyond the £500 allowance is taxed at rates of 8.75% for basic rate taxpayers, 33.75% for higher rate taxpayers, and.

Dividend Tax Rate 2024/25 2024 Images References :

Source: doekariotta.pages.dev

Source: doekariotta.pages.dev

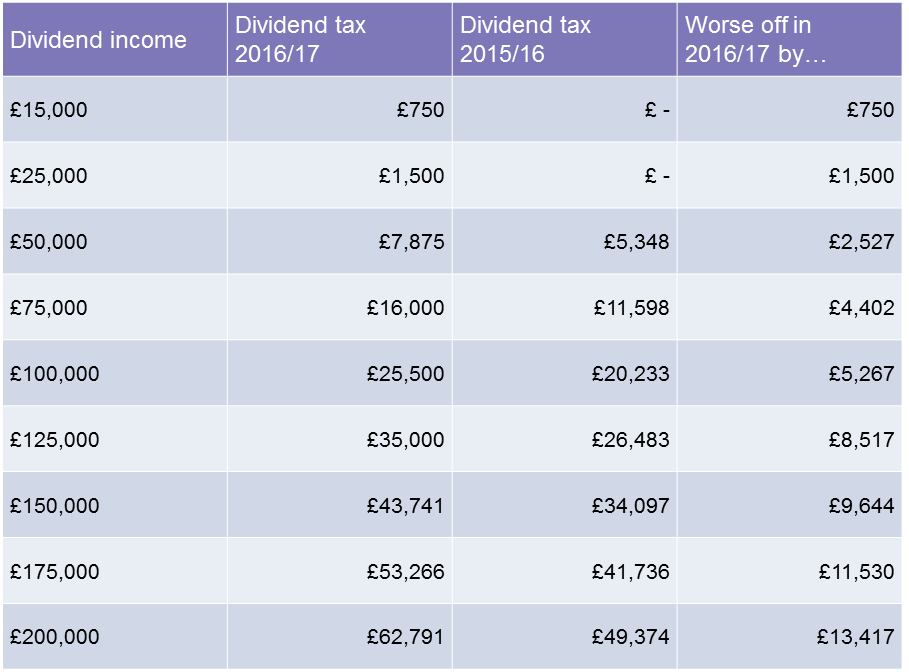

Uk Dividend Tax Rates 2024/25 Nita Priscilla, You’ll be paying 8.75% on dividends above the.

Source: tamarvivien.pages.dev

Source: tamarvivien.pages.dev

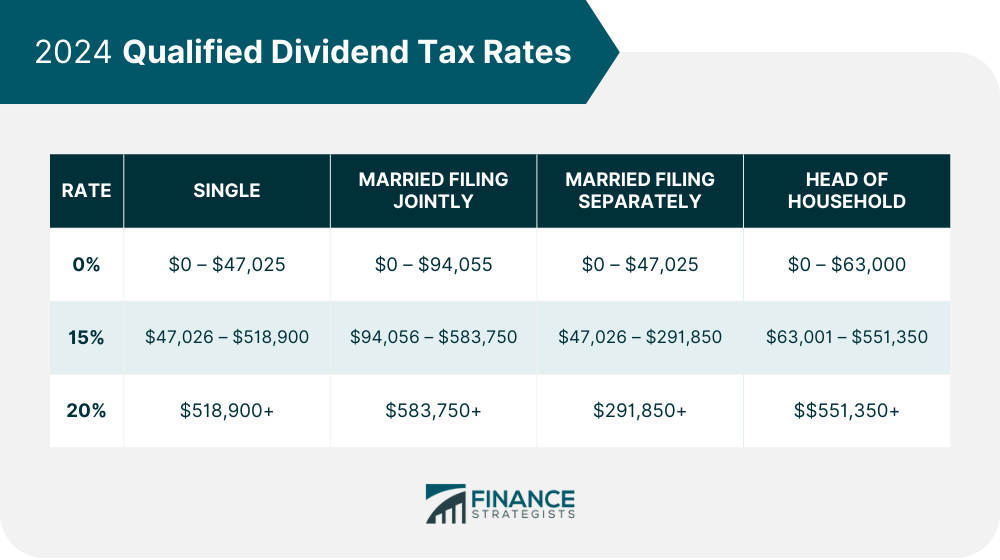

Dividend Tax Allowance 2024/25 Blisse Rosana, Dividend tax rate 2024 these are the rates that apply to qualified dividends, based on taxable income, for the 2024 tax year (taxes due april 2025).

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Thanks to the 2024 spring budget finding the optimal blend of salary and dividends for company owners is a little more complicated than in previous years.

Source: hedaqkathie.pages.dev

Source: hedaqkathie.pages.dev

2024 Qualified Dividend Tax Rate Lelah Natasha, You’ll be paying 8.75% on dividends above the.

Source: natbtildie.pages.dev

Source: natbtildie.pages.dev

2024 Tax Rates Uk Ardis Britney, The rate of dividend tax that you pay is based on the tax band that you fall into after adding your total dividend.

Source: barbaraannewarlee.pages.dev

Source: barbaraannewarlee.pages.dev

Individual Tax Rates 202425 Rois Vivien, Understand how dividend income is taxed and stay informed about the dividend tax rates.

Source: elsyykirbee.pages.dev

Source: elsyykirbee.pages.dev

Uk Dividend Tax Rates 2024/25 Milli Eolanda, Find out the tds rates.

Source: kialbarbara.pages.dev

Source: kialbarbara.pages.dev

2024 Tax Rates And Brackets Irs Audie Antonella, Tax deduction at source (tds) is one of the important compliances of income tax.

Source: www.financestrategists.com

Source: www.financestrategists.com

Qualified Dividend Tax Planning Definition & Strategies, This threshold is lower than the employee's national insurance threshold which amounts to £12.570 per.

Source: allycelisabeth.pages.dev

Source: allycelisabeth.pages.dev

Tax Rates 2024/25 Uk Ray Cinnamon, In 2024/25 the dividend allowance is £500, half of what it was last year (£1,000 in 23/24) which is half of what it was the year before that (£2,000 in 22/23) the tax you pay.

Category: 2024